How to reconcile Salespeople and Financiers?

Article – 20/06/2018

The goal of the Sales department is to achieve maximum sales, the risk profile of clients and their capacity to pay their bills is not its primary concern!

The goal of the finance department is to keep DSO as low as possible and bring in as much cash as possible, so it tends to focus on eliminating the riskiest prospects and clients that are the biggest defaulters.

So, we have two opposing worlds: salespeople often perceive financiers as overly cautious people who prevent them from doing business, accusing them of “undermining sales” on the grounds of precaution.

So how is it possible to reconcile sales and finance, which can sometimes be at loggerheads?

Guillaume WERLÉ

Investigations & Credit Director with URIOS

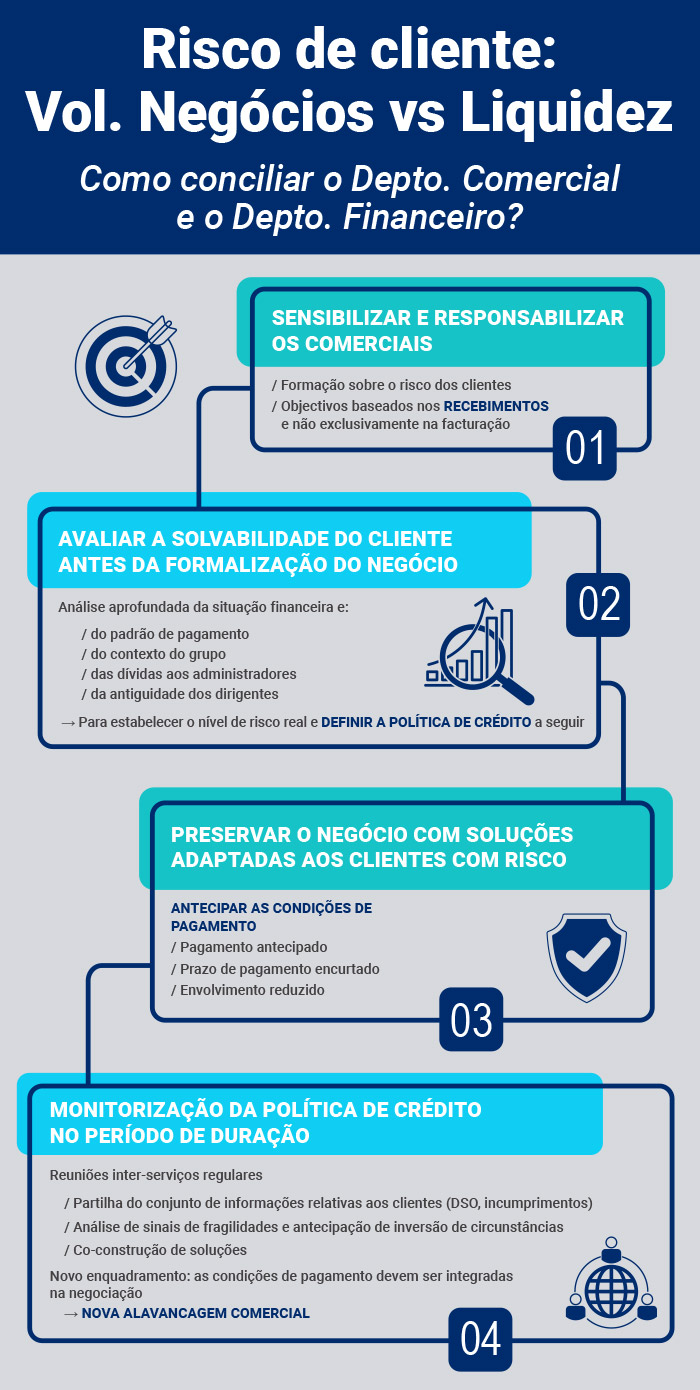

1. Involve and empower salespeople regarding the financial implications of their sales

A company has everything to gain from involving its salespeople in the financial implications of after-sales. Let us recall that following a default of 24,000 €, with a 5% margin, additional turnover of 480,000 euros will have to be generated to compensate for this loss. This is a sobering thought that could enable Salespeople to understand that it is in their own interest to think in terms of “payments” rather than in terms of “turnover”, because otherwise their sales objectives could drastically increase the following year.

To promote this approach, Senior Management could set salespeople new objectives, alongside the traditional turnover objective: a DSO objective, an annual arrears objective and commission for salespeople based on payments rather than on turnover.

Once client credit management objectives have been firmly established for salespeople, it would be very useful to involve them in financial management of clients. For example, salespeople will receive an email alert when one of their clients has not respected their payment terms.

Clients will feel less “harassed” if the first dunning for an invoice is received from the salesperson, who they know and with whom a relationship of confidence has developed, rather than directly from the supplier “accounts/finance”’ department. They will also be able to deal with any disputes faster.

2. Analyse the risk of the business relationship

Many companies are still too focused on turnover, with finance only checking the financial health of a client when the salesperson comes back to the office with the contract signed.

But the approach should be proactive rather than reactive. Finance should be called in to check the risk profile of the prospect before the sale is signed. The objective must be to generate quality, profitable turnover rather than simply generate turnover. In order to achieve this, critical selection of prospects and clients must be carried out upstream rather than thinking “all clients are good for the taking”.

So, before entering into or continuing a business relationship, it is important to analyse the financial situation of a company: is it solvent? sustainable? what are the risks of default? The answer to these questions will determine the credit policy to be implemented: credit limit, payment deadlines, advance payments, partial deliveries to reduce outstanding payments, request for guarantees…

To obtain consensus from everyone, it is crucial to use a solvency indicator or score. Several stakeholders on the market (financial databases) provide risk scores. Based solely on financial data that may be out of date (many companies do not publish their results or make them confidential), these are often a long way from reality.

Our advice is to go beyond this score and analyse the company from several angles:

- Financial, of course: balance sheet, profit and loss account (financial structure, liquidity, debt, profitability). But analysing available balance sheets is not enough, we need to evaluate the financial situation of a company at a precise moment in time, not 1 year previously. It is therefore necessary to obtain the initial trends of the most recent balance sheet, as yet unpublished, as well as an interim or projected situation for the year in progress. Especially when a company does not publish its balance sheets.

- Payment behaviour: it is necessary to obtain information from the company’s bank – with explicit agreement from the company director – and from its suppliers, in order to find out if it is in arrears or if it makes significantly late payments to its suppliers.

- Debts owed to the tax administration, social security and family support contributions collection body, and state pension fund: it is necessary to find out if there is a record of billing privileges (and therefore arrears) to the benefit of the social and fiscal authorities, and, more importantly, to ascertain whether a moratorium exists.

- Consideration of the group’s context: poor results of a subsidiary could become relative if the subsidiary is financially supported by a substantial group with strong financial standing.

- Consideration of the length of time the director has been at the head of the company to check if he/she was already involved in bankruptcies in the past.

To do this, an in-depth investigation and a detailed financial analysis are vital.

3. Safeguarding the business!

4. Work in close collaboration right from the prospection phase

Once salespeople are fully involved in the financial implications of their sales, it would be very useful to give them access to the risk analysis tools used by finance.

Financiers need flawless knowledge of a client and information from the field to determine the client’s score. But salespeople, who are in direct contact with their clients, are the ones who know clients best. They must be a source of precious information for financiers from the prospection phase.

Together, financiers and salespeople must coordinate credit risks over time. To do this, financiers must attend sales meetings. These inter-departmental meetings should be encouraged to review evolution of DSO and arrears, and to discuss “tricky” files. During these meetings, financiers, acting as “whistle blowers”, can present the situation of a deteriorating client account and agree with salespeople on the approach to be taken.

In fact, why would financiers not also be present when contracts are signed, in the case of a client whose risk profile features certain weaknesses? This would relieve salespeople of the burden of negotiating payment terms and safeguard the good relationship they have developed with their clients. Salespeople fear that this type of discussion may compromise the signature of the sale, which is understandable, but they should make it a commercial opportunity for clients: if the latter pay quickly, they will benefit from advantageous conditions in the form of a discount for example.

In conclusion, the company must no longer be considered as a series of independent functions (production, sales, finance) but, on the contrary, as an organisation with interconnected departments, through which horizontal flows pass. So, at each stage of the sales process, sales and finance work in interaction. Even better: finance intervenes to support sales, not in opposition to sales.

It is worth noting that the specific role of the credit manager is to reconcile commercial issues with financial imperatives. The implementation of a credit management department and a credit manager at the meeting point between the Sales and Finance Departments enables sales and finance to be connected. Unfortunately, this approach is too often limited to large companies.

Financial Intelligence

Evaluate the financial health of your partners to protect yourself from default risks and adapt your intercompany credit conditions.

READ MORE